Many companies retain all profits and use them to fund business expansion. However, some are so profitable that they have more money than they need to grow their business. This allows them to return cash to investors by buying back shares and paying dividends.

Despite investing billions of dollars in artificial intelligence (AI), major companies like Broadcom (NASDAQ: AVGO), Microsoft (NASDAQ: MSFT), and Meta Platforms (NASDAQ: META) We are making a profit. This allows investors to enjoy the best of both worlds. They are taking advantage of the megatrend while earning a salary income. That revenue stream may be small now, but it could become even more powerful in the future as these companies profit from AI.

Not an average dividend

Broadcom pays investors a quarterly dividend of $0.53 per share. With its recent stock price around $180, the semiconductor and software company has a dividend yield of 1.2%. That’s about average considering the S&P 500’s dividend yield is around that level. At that rate, for every $1,000 you invest in Broadcom stock, you’ll earn about $12 in dividend income each year. The more you invest, the more you earn.

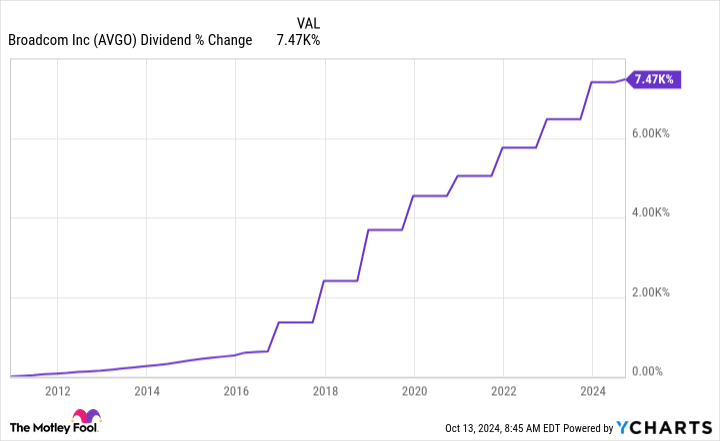

What’s noteworthy about Broadcom’s dividend is its growth. The company achieved its 13th consecutive dividend increase at the end of last year, raising its payout by 14%. We achieved incredible dividend growth during this period.

AVGO Dividend Chart

AVGO Dividend Data by YCharts

Broadcom should be able to continue increasing its dividend at a high pace going forward. The company’s revenue rose 43% year-over-year in the second quarter, and free cash flow rose 18%. The acquisition of VMware was a big driver. But even without that accelerator, it’s still growing rapidly, with record $3.1 billion in revenue from AI products. Specifically, after excluding VMware, revenue increased by 12%. With further AI-driven growth expected in the future, Broadcom should be able to continue increasing its dividend at an above-average rate.

Yield is low but growth is strong

Microsoft recently announced its latest quarterly dividend. The tech giant increased its quarterly payout by 10% to $0.83 per share. In other words, the dividend yield at the recent stock price is approximately 0.8%.

While Microsoft has a low dividend yield, it has a high dividend growth rate. The company has increased payments for 19 consecutive years, and at an annual rate of more than 10% over the past 10 years.

Microsoft is in a great position to continue paying a growing dividend. The company’s low dividend payout ratio allows it to preserve cash for business growth and stock repurchases. The company’s board of directors recently approved up to $60 billion in stock repurchase authorization. Meanwhile, the company is investing heavily in AI, pouring billions into OpenAI, the creator of ChatGPT, to access its technology and help deliver cutting-edge AI products and services. These investments should continue to increase cash flow and dividend paying capacity.

story continues

new with many possibilities

Metaplatform just started paying dividends this year. The social media giant began paying a quarterly dividend of $0.50 per share in February. At the current stock price, the dividend yield is approximately 0.3%.

Meta Platforms has a relatively new dividend and low yield, but it has a lot of potential. The company is starting small so it can invest heavily in AI. The company announced its own AI assistant, Meta AI, earlier this year and expects it to become the most used AI assistant by the end of the year. The company is also launching AI tools for advertisers, which CEO Mark Zuckerberg believes is “going to be a huge thing.”

It will take some time for Meta to monetize some of its AI products. However, we have an excellent track record of building, scaling, and monetizing investments. As such, AI could be a major driver of long-term profit growth for the company. This should allow Metaplatform to significantly increase its dividend over the next few years.

Capitalize on the AI boom

Many emerging AI companies need to keep all profits so they can continue investing in their technology. But Broadcom, Microsoft, and Meta Platforms are so profitable that they invest in AI and earn enough to pay dividends to their investors. These are the best AI stocks to buy for those looking to raise cash while capitalizing on this megatrend.

Should you invest $1,000 in Broadcom right now?

Before buying Broadcom stock, consider the following:

Motley Fool Stock Advisor’s team of analysts has identified the 10 best stocks for investors to buy right now. Broadcom was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $826,069. *

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. Stock Advisor services have increased S&P 500 returns more than 4x since 2002*.

See 10 stocks »

*Stock Advisor will return as of October 7, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Matt DiLallo holds positions at Broadcom and Meta Platforms. The Motley Fool has a position in and recommends Meta Platform and Microsoft. The Motley Fool recommends Broadcom and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

Want to make money from AI? These top tech stocks pay money to own them. Originally published by The Motley Fool