(Bloomberg) — Stock futures in Asia and Europe rose after hitting record highs on Wall Street, helped by technology stocks. Oil fell as concerns about an Israeli attack on Iranian energy facilities eased.

Most Read Articles on Bloomberg

MSCI’s Asia-Pacific index rose as much as 0.7% on the back of gains in the chip sector. Two companies, Taiwan Semiconductor Manufacturing Co., Ltd. and SoftBank Group, greatly contributed to the benchmark’s breakthrough. Japan’s Nikkei stock average index rose again, reaching its highest level since July. Benchmarks in Australia and Taiwan also made progress.

Oil fell after the Washington Post reported that Israel is not planning attacks on Iran’s oil or nuclear facilities.

Stock prices in China and Hong Kong fell as investors focused on further stimulus from the Chinese government. The country’s stock index rose on Monday, even though a highly anticipated weekend briefing from the Treasury Department lacked any concrete new incentives to boost consumption in the world’s biggest oil importer. .

Chinese media outlet Caixin reported that China could raise 6 trillion yuan ($846 billion) over three years in super-long-term special bonds as part of efforts to boost its sluggish economy.

“This is not the ‘bazooka’ some are calling for, defined as a significant increase in fiscal stimulus,” Michael Herson and Howes Song of 22V Research said in a note. “At face value, it’s essentially a continuation of China’s current phased approach.”

Chinese banks will cut interest rates on 300 trillion yuan ($42.3 trillion) of deposits as soon as this week, according to people familiar with the matter, as a recent round of stimulus measures further pressures profitability. It’s planned.

Still, Monday’s report showed export growth in September unexpectedly rose just 2.4% year-on-year in dollar terms, the lowest level since May, a sign of economic weakness. is increasing further. Still, the country’s auto and ship exports set records in September even as broader shipments slowed, highlighting rapid changes in the domestic industry that are fueling global trade tensions.

“To get the economy going again, we need to see fundamentals support policy tailwinds,” Standard Chartered Wealth Solutions Group CIO Steve Bryce said on Bloomberg TV.

story continues

Meanwhile, reflecting hot demand for Japan’s biggest listing in six years, Tokyo Subway’s initial public offering price was set at the highest market price, raising 348.6 billion yen ($2.3 billion), according to people familiar with the matter. The matter was said.

Markets are also looking forward to Hong Kong leader John Lee’s annual speech on Wednesday. He is expected to make economic support a priority and present an agenda that includes possible lower liquor taxes and possible measures to strengthen the city’s fiscal position. center.

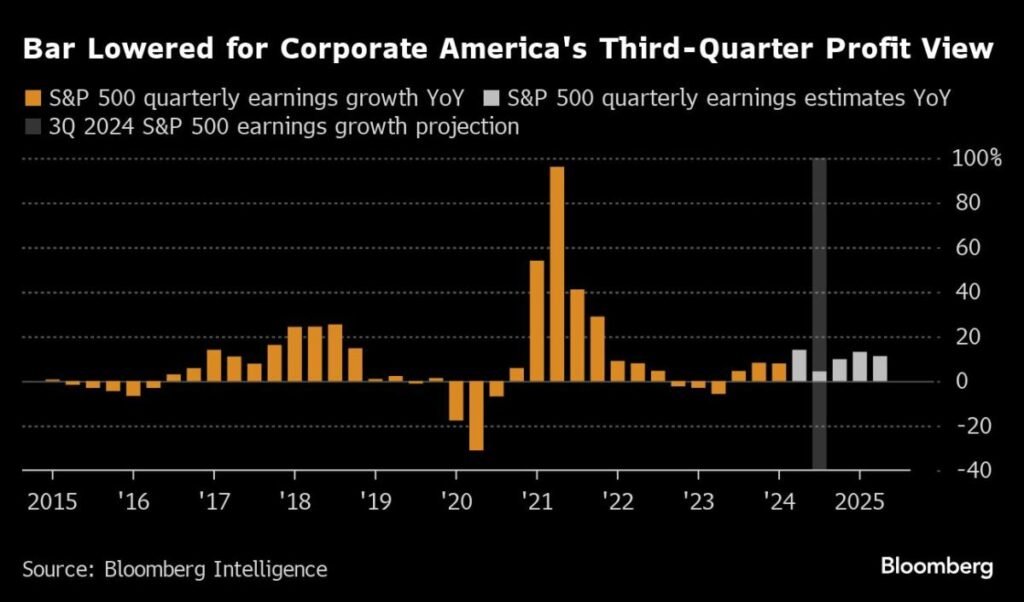

Earnings releases are expected to boost U.S. sentiment this week, with the S&P 500 rising nearly 1% on Monday, hitting a new record for the 46th time this year. This suggests investors are not daunted by downward revisions to third-quarter earnings forecasts, but are instead betting on a positive surprise.

The Nasdaq 100 rose 0.8%. Nvidia Inc. led the rally in mega-cap stocks, Apple Inc. rose after analysts’ bullish calls and Tesla Inc. rebounded from last week’s sharp decline. Goldman Sachs Group and Citigroup outperformed.

Japanese stocks were among the biggest gainers on Tuesday.

Naoki Fujiwara, senior fund manager at Shinkin Asset Management, points out, “Considering the situation in the United States and China, there is no selling point in the macro environment, and Japanese stocks are cheap.”

U.S. Treasury yields were slightly lower on Tuesday as spot trading was closed on Monday for a national holiday. The yen remains at a level not far below 150 yen against the dollar, which is an important psychological level for investors to be aware of the risk of intervention.

In the United States, the earnings season unofficially opened on Friday, led by financial leaders JPMorgan Chase & Co. and Wells Fargo & Co. In addition to other major banks reporting this week, traders will be paying close attention to the results of major companies like Netflix Inc. and JB Hunt Transport Services Inc.

According to Bank of America strategists Oson Kwon and Savita Subramanian, the initial third-quarter earnings report released last week showed that Corporate America was on the brink of the early stages of the Federal Reserve’s easing cycle. The results show that they are benefiting from lower interest rates.

In other news, Biden administration officials are discussing country-by-country restrictions on sales of advanced AI chips from Nvidia and other U.S. companies, which would limit some countries’ artificial intelligence capabilities. Officials said it will be done.

Bitcoin firmed after rising 5% on Monday on growing signs that the U.S. regulatory outlook for the crypto sector will improve after the next presidential election.

This week’s main events:

Eurozone industrial production, Tuesday

Goldman Sachs, Bank of America and Citigroup earnings Tuesday

Fed’s Mary Daly and Adrianna Kugler speak on Tuesday

Morgan Stanley earnings results Wednesday

ECB interest rate decision, Thursday

U.S. retail sales, unemployment claims, industrial production, Thursday

Fed’s Austan Goolsby speaks on Thursday

China GDP, Friday

Fed’s Christopher Waller and Neel Kashkari speak on Friday

The main movements in the market are:

stock

S&P 500 futures were little changed as of 2:06 p.m. Tokyo time.

Japan’s TOPIX rose 1%

Australia’s S&P/ASX 200 rose 0.8%

Hong Kong’s Hang Seng fell 1.6%.

The Shanghai Composite fell 0.8%.

Euro Stoxx50 futures rose 0.4%

currency

Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.2% to $1.0891.

The Japanese yen remained almost unchanged at 149.67 yen to the dollar.

The offshore yuan fell 0.4% to 7.1261 yuan to the dollar.

cryptocurrency

Bitcoin fell 0.6% to $65,486.49.

Ether fell 0.4% to $2,609.43.

bond

The 10-year government bond yield was almost unchanged at 4.09%.

Japan’s 10-year bond yield rose 2 basis points to 0.965%.

The Australian 10-year bond yield fell two basis points to 4.25%.

merchandise

West Texas Intermediate crude oil fell 3.5% to $71.25 a barrel.

Spot gold fell 0.2% to $2,642.19 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Sherry Ann and Jason Scott.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP