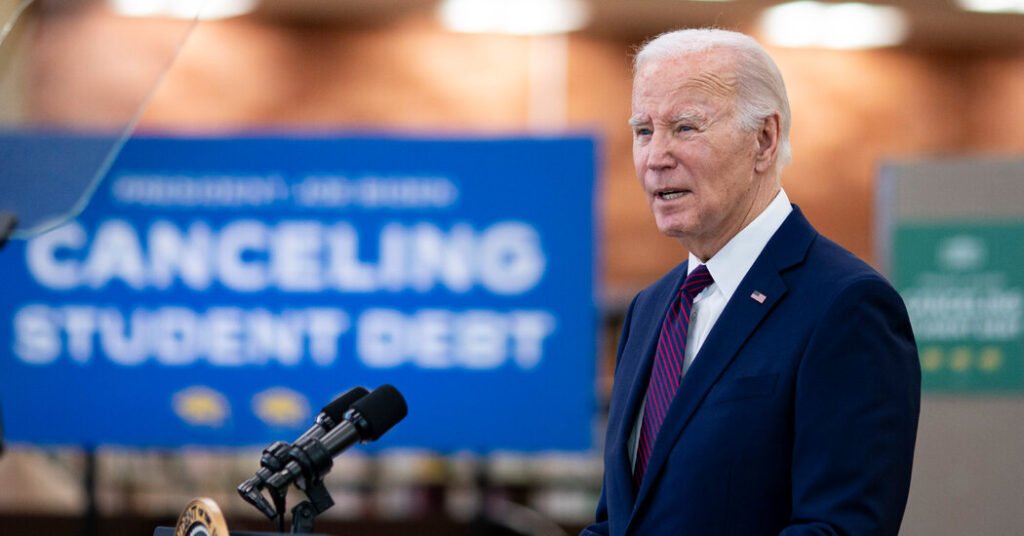

A federal judge in Missouri temporarily blocks the Biden administration’s plan to cancel student loans, affecting more than 27 million borrowers, less than a day after another judge allowed it to proceed. Possibly created uncertainty over the fate of the program.

The decision, made late on Thursday, hampers the administration’s efforts to complete the program before President Biden leaves office in January, and it is expected to slow the administration’s efforts to complete the program before President Biden leaves office in January. It was the latest hurdle to halt the president’s efforts. Several programs have been postponed due to legal challenges, and the program suspended Thursday has now been suspended twice.

The program would forgive up to $20,000 in unpaid interest on loans and forgive unpaid loans for borrowers who started repaying their loans decades ago. This is the largest piece of the president’s multifaceted effort to propose broad student loan forgiveness after the Supreme Court rejected his initial plan.

A coalition of seven Republican states last month rejected the plan, arguing that the Education Department was rushing to lay the groundwork for the plan before it was completed and that its proposed debt cancellation could financially harm states and federal loan servicers. A lawsuit was filed to stop it. Judge J. Randall Hall of the U.S. District Court for the Southern District of Georgia temporarily blocked it a month ago. The hold was then lifted on Wednesday and the case was subsequently transferred, concluding that Missouri was a more appropriate venue.

In a candid order Thursday, Judge Matthew T. Shelp of the U.S. District Court for the Eastern District of Missouri wrote that states are likely to succeed in challenging the program as illegal. In his argument, he cited a July ruling by the Eighth Circuit Court of Appeals that blocked the government’s other major student loan program, the SAVE program.

Judge Shelp said that if the program’s hold period expires now, the Department of Education could cancel large amounts of debt if the court rules that the program is illegal, which could make recovery later difficult. It was inferred that there is a sex. So he put the hold back in place.

Referring to the Department of Education, a defendant in the case, Judge Shelp wrote: “If we allow the defendants to discharge the student loan debt at issue here, this court, the U.S. Court of Appeals, and the Supreme Court will be unable to consider this issue in court.” , allowing the defendant’s conduct to evade review. ”

The Department of Education criticized the ruling and the lawsuit in a statement, saying it was brought by Republican elected officials who have made it clear they will stop at nothing to prevent millions of voters from taking a break from their student debt. ” he said.

Other critics of the case called the decision a politically motivated preemption of a program whose details are still being worked out.

Persis Yu, deputy executive director of the Student Borrower Protection Center, said: “Today’s decision is an unprecedented move to block proposed federal student debt relief regulations that have not yet been finalized or implemented, despite a lack of legal basis. I’ll take it.” said in a statement. “This case lacks seriousness, and the judge’s order completely exposes our occupied courtrooms.”

On Wednesday night, Judge Hall ruled in Georgia that the state had not shown it stood to suffer damages under the program and could not be party to the lawsuit.

But the ruling moves the case to friendlier territory in Missouri, with Missouri Attorney General Andrew Bailey arguing that it could directly harm the Missouri Higher Education Loan Authority, known as MOHELA. It’s a big victory for the Biden administration’s student loan policies. A semi-independent student loan servicer based in his state.

“This is a huge victory for transparency, the rule of law, and all Americans who don’t have to pay for someone else’s Ivy League debt,” Bailey said on social media.