Semiconductors or chips are essentially the building blocks of modern technology. They are often made from silicon sliced into thin wafers and contain millions of microscopic circuits. As you can imagine, semiconductor manufacturing is a highly complex process that requires cutting-edge technology.

Lam Research (NASDAQ: LRCX) sells specialized equipment used in semiconductor manufacturing. The company’s history dates back to the 1980s, but investors should be excited about its future potential thanks to the rise of artificial intelligence (AI).

Stocks won’t make you rich overnight, but they can help retire millionaires as part of a diversified long-term portfolio. Here’s why:

The smaller the chip, the greater the investment opportunity

The investment pitch for Lam Research boils down to the company’s important role in the semiconductor space and technology trends.

Lam Research sells a variety of products used in manufacturing, a term used to describe the semiconductor manufacturing process. As manufacturing technology improves, companies will be able to fit more circuitry onto smaller chips. That’s why today’s smartphones fit in the palm of your hand, yet contain computers that are exponentially more powerful than the desktop computers of 1990.

Modern electronic devices use increasingly complex chips, and more chips are needed. This has created decades of steady demand for Lam Research’s products, a trend that doesn’t seem to be ending anytime soon.

Various future technologies will require highly complex semiconductors, including:

According to McKinsey & Company, companies around the world could invest as much as $1 trillion in manufacturing by 2030. Efforts are underway to place more circuits on smaller pieces of silicon. The end result is technology that would have been the stuff of science fiction a decade or two ago. We don’t know what the world will look like in 20 or 30 years, but Lam Research’s equipment will likely help build it.

Lam Research is a genuine formular

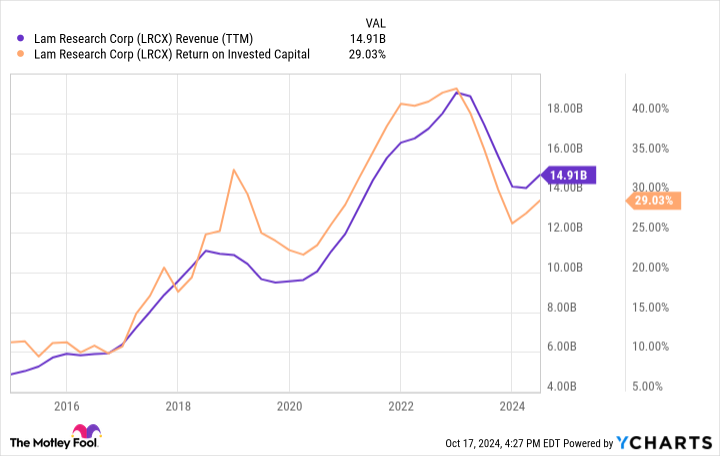

Lam Research is prone to boom-and-bust investment cycles within the semiconductor industry. You can see how it affected annual sales.

LRCX Revenue (TTM) Chart

More important than the annual ups and downs is that the overall trend is up. We also like that Lam Research’s return on invested capital (ROIC) is improving over time. This indicates that the business may be using its financial resources to effectively create value and exhibit a competitive moat. I usually look for companies that consistently score above 10%, and Lam Research easily clears that.

A consistently high return on capital can snowball over years or decades and help drive revenue growth (and investment returns). Since the mid-1980s, the company’s stock has returned more than 37,938%, turning an investment as small as $1,000 into an investment of more than $379,380.

Good price to buy today

The longer you hold a stock, the more the company’s growth and ROIC will affect stock returns. This is why famous investor Warren Buffett prefers to invest in great companies at fair prices rather than average companies at low prices. In other words, you don’t have to deal with great companies like Lam Research. As long as the price is reasonable, the stock should take care of itself in the long run.

Lam Research has been steadily retreating from its highs since July. China is a big customer for Lam Research, raising concerns about how geopolitical tensions will affect the business. Additionally, recent overwhelming guidance from peer ASML has weighed on semiconductor equipment stocks. ASML warned of weak demand for non-AI chips.

Remember, the semiconductor industry has its ups and downs, and as long as the industry grows over time, Lam Research will be fine. The good news is that these concerns have pushed the stock down to a price that is attractive to buyers. The company’s stock trades at about 23 times 2024 earnings estimates, and analysts expect the company’s profits to grow an average of 13% to 14% annually over the next three to five years. Given the expected growth, the price-to-earnings ratio of 24 times is not cheap, but it is quite reasonable for long-term investors.

Lam Research is a blue-chip company looking to ride the wave of innovation across AI and other technologies. I wouldn’t be surprised if this stock continues to make investors very rich over the next 20 or 30 years.

Don’t miss out on this potentially lucrative second chance

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

Amazon: If you invested $1,000 when it doubled in 2010, you’d get $21,285!*

Apple: If you invested $1,000 when it doubled in 2008, you’d get $44,456!*

Netflix: If you invested $1,000 when it doubled in 2004, you would have earned $411,959. *

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 14, 2024

Justin Pope has no position in any stocks mentioned. The Motley Fool has roles in and recommends ASML and Lam Research. The Motley Fool has a disclosure policy.

Can Lam Research stock help billionaires retire? Originally published by The Motley Fool