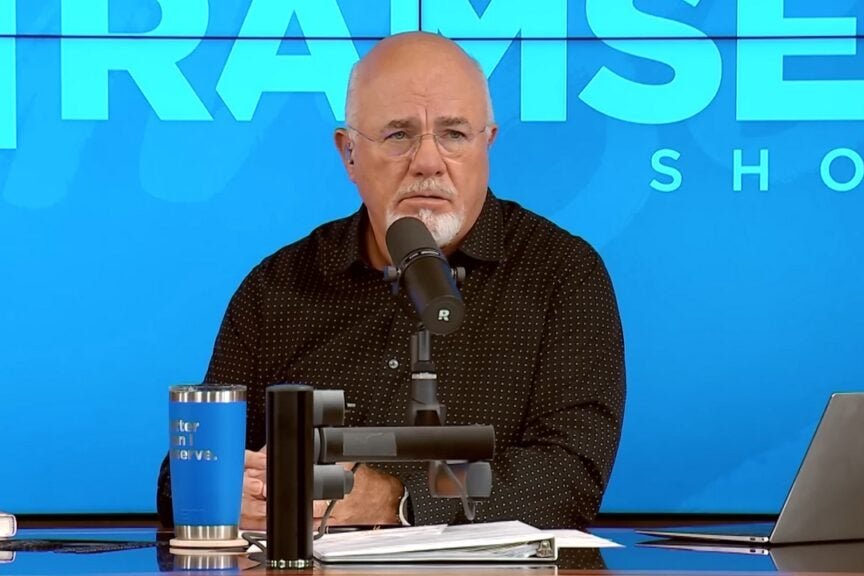

When you think of billionaires, you probably think of professions like technology entrepreneurs or Wall Street brokers. But that may not be the case for most billionaires, according to financial expert Dave Ramsey. In a recent study by his team, Ramsey revealed the top five careers of billionaires, and they weren’t exactly what you’d expect.

Spoiler alert: These careers don’t necessarily bring big paychecks, but they do seem to have something in common. Take a look at our amazing list.

Don’t miss:

Top 5 jobs most likely to make a millionaire

1. Engineer

Median salary: $91,010

2. Accountant (certified public accountant)

Median salary: $77,250

3. Teacher

Average salary: $61,030

4. Management

Median salary: $107,360

5. Lawyer

Median salary: $135,740

Did you notice anything? Physicians are not in the top five and, contrary to popular belief, are in sixth place.

Trending: Personal Capital founder and former PayPal CEO redesigns traditional banking with this new high-yield account. Start saving wisely today.

Just because salaries are high doesn’t necessarily mean there will be more millionaires.

It is often thought that a high salary is a shortcut to wealth, but this is not always the case. For example, the average salary for lawyers is $135,740, the highest on this list, but it ranks fifth in terms of careers that produce millionaires. Conversely, teachers, who earn an average salary of just $61,030, rank third.

What gives? Ramsey’s research shows that becoming a millionaire is less about earning the highest salary and more about how you spend your money.

SEE ALSO: How do billionaires pay less income tax than you? Tax deferral is their number one strategy.

So what do these careers have in common?

The key, Ramsey said, is to be “a process person.” These professionals stick to systems and processes, whether it’s managing accounts, following legal process, or teaching in the classroom. Applying this same thinking to your personal finances appears to help you build wealth over the long term.

The mindset of millionaires is more important than their salary.

The bottom line is that one-third of the billionaires in Ramsey’s study earned less than $100,000 a year. What about take-home? You don’t need a huge salary to become a millionaire. Consistent savings, smart investing, and living below your means can make all the difference.

Why home ownership is important

Ramsey also emphasizes that homeownership is an important component of wealth building, especially for people with a net worth of $1 million to $10 million. For many people, their home is their greatest asset, and paying off their mortgage can help them succeed financially.

Trending: This Jeff Bezos-backed startup lets you become a landlord in just 10 minutes and all you need is $100.

To become a millionaire, the journey is more important than the destination.

Dave Ramsey’s research reminds us that wealth is not just for those with high careers or high incomes. Millionaire status is determined by developing disciplined habits and sticking to them over time. Living on less than your means and investing consistently can help your financial future better than chasing the highest paycheck.

Whether you’re a teacher, accountant or engineer, Ramsey’s findings offer hope for building wealth. Rather, this proves that becoming a millionaire is possible for more people than you think.

Read next:

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.