“The data shows that health and wellness is a priority for consumers and that they are always willing to pay for it,” said Jeff McQueen, managing partner at LEK Consulting, which analyzed the data and wrote the report. “Memberships at fitness facilities tend to be particularly high.” It’s a strong value proposition, with operators recognizing that they may be able to increase rates without significantly impacting their membership base, believing in the value they can offer to consumers, and considering recent inflation and labor costs. efforts should be made to offset the rise in ”

This report provides a comprehensive analysis of American fitness consumers affiliated with fitness facilities. This report covers important metrics such as membership growth by facility type, attendance and tenure, facility usage, activity participation, and individual and small group training usage. , provides insights and takeaways for fitness facility owners and operators, investors, and private equity firms. and suppliers and others.

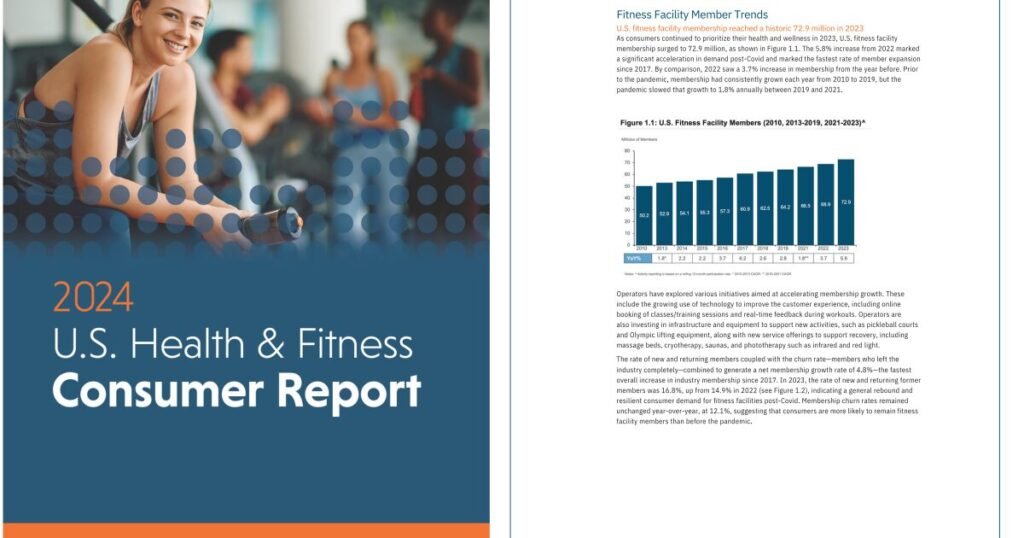

The data points to a healthy operating environment and a bright future for the health and fitness industry.

Despite a more broadly challenging economic environment, strong membership growth, expansive development in niche markets, and the consistent maturation of their own demographics over the years have shown that fitness facilities continue to offer their consumer base. Evidence of a strong value proposition.

Severin and McQueen, managing partners at LEK Consulting, who analyzed the data and created the report, share four data points from the report that reveal what consumers value and where businesses can grow: shared in the video.