company logo

Global Naval Combat Systems Market

Global Naval Combat Systems Market

DUBLIN, Oct. 18, 2024 (GLOBE NEWSWIRE) — “Naval Combat Systems Market – Global Industry Size, Share, Trends, Opportunities, and Forecast, 2019 to 2029” report is now a service of ResearchAndMarkets.com Added.

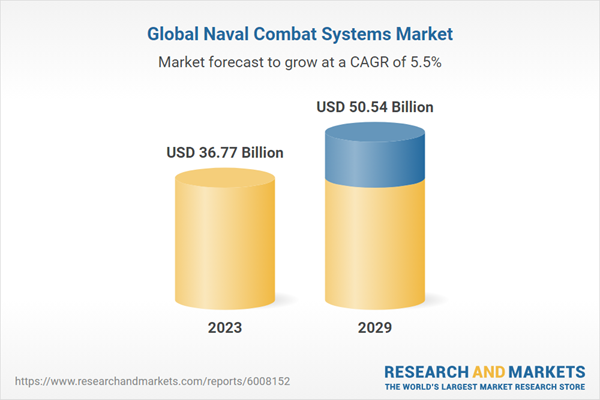

The global naval combat systems market was valued at USD 36.77 billion in 2023 and is expected to reach USD 50.54 billion by 2029, growing at a CAGR of 5.50%. The global naval combat systems market is witnessing steady growth due to several key drivers and evolving trends. The main driver of growth is the growing need for advanced defense mechanisms to ensure national security amid rising geopolitical tensions.

Modern naval combat systems, including radar systems, missile defense systems, and electronic warfare equipment, are essential to strengthening the Navy’s strategic capabilities. Technological advances, such as the integration of artificial intelligence and automation, are greatly increasing the effectiveness and efficiency of these systems. The push for naval modernization around the world, coupled with increasing national defense budgets, is further accelerating market growth.

Emerging trends in the naval combat systems market highlight a shift towards more sophisticated and interconnected systems. The development of network-centric warfighting capabilities, enabling real-time data sharing and enhanced situational awareness, is transforming naval combat strategy. There is an increasing emphasis on modular and adaptable systems that can be customized to meet diverse mission requirements. Integrating unmanned and autonomous systems into maritime combat operations is also gaining attention, increasing operational flexibility and reducing human risk. These trends reflect a broader move towards more versatile and integrated combat solutions in modern naval warfare.

The market faces several challenges that may impact its growth trajectory. One of the major challenges is the high costs associated with developing and fielding advanced naval combat systems. The complexity of these systems often leads to extended development cycles and large investment requirements, which can be a barrier for some countries and defense contractors. Rapid technology change requires continuous upgrades and innovation, which can put a strain on resources and budgets. Additionally, the need for interoperability between different systems and international standards can create technical and regulatory challenges. Addressing these challenges while maintaining growth momentum is of critical importance for Naval Combat Systems market players.

Modernization and recapitalization of the naval fleet

One of the key market drivers for the global naval combat systems market is the urgent need for modernization and recapitalization of naval fleets across the world. Many countries with significant maritime interests are faced with aging warships and combat systems that have reached the end of their operational lives. As a result, countries are embarking on ambitious naval modernization programs to improve their capabilities and remain competitive in the maritime domain. Many navies are equipped with ships and systems that have been in service for decades, making them technologically outdated and operationally inefficient.

Geopolitical tensions and maritime security concerns

Geopolitical tensions and maritime security concerns are the key driving forces shaping the global naval combat systems market. As countries seek to protect their territorial waters, exclusive economic zones (EEZs), and maritime interests, they need to strengthen their naval capabilities to deter potential adversaries and assert control over strategically important areas. It is becoming more and more important. Geopolitical tensions often revolve around territorial disputes and competing claims in the South China Sea, Black Sea, and other regions, increasing the need for naval presence. Defending freedom of navigation and protecting the world’s maritime trade routes, such as the Strait of Hormuz and the South China Sea, are critical security concerns.

New naval technology and innovation

Continuous development of new naval technologies and innovations is a key driver of the global naval combat systems market. Advances in areas such as artificial intelligence, autonomous systems, directed energy weapons, and stealth technology are revolutionizing naval warfare and shaping the future of naval warfare systems. AI and machine learning enable advanced data analytics, predictive maintenance, and autonomous operations to improve the effectiveness and efficiency of naval vessels. The proliferation of unmanned surface vessels (USVs), unmanned underwater vehicles (UUVs), and unmanned aerial vehicles (UAVs) is expanding the navy’s reach and capabilities.

High-energy laser (HEL) and radio frequency (RF) weapons can respond to threats quickly and accurately, reducing reliance on conventional munitions. Advances in stealth technology have made naval vessels more difficult to detect and track, improving survivability in modern naval warfare. Protecting naval systems against cyber threats and integrating electronic warfare capabilities is critical to maintaining operational security. These emerging naval technologies drive research, development, and innovation in the global naval combat systems market. Countries are investing in these technologies to maintain technological superiority and remain competitive in the evolving maritime security environment.

In December 2023, it was announced that the SSN-AUKUS submarine, a joint project between Australia and the UK, will be equipped with an upgraded AN/BYG-1 combat control system. The system is already used on the Australian Navy’s Collins-class submarines and various U.S. Navy nuclear-powered submarines.

Automation and unmanned systems

Automation and the use of unmanned systems are increasingly prevalent trends in the global naval combat systems market. Automation streamlines operations, reduces crew workload, and improves ship performance, while unmanned systems extend the Navy’s reach and increase mission flexibility. Naval combat systems are becoming increasingly automated, allowing for faster target attack, fire control, and decision-making. Automation reduces crew workload and improves weapon system accuracy. Unmanned surface vessels are used for a variety of missions, including mine countermeasures, anti-submarine warfare, and reconnaissance. These systems expand the Navy’s capabilities by operating in areas that are too dangerous for manned vessels.

Insights by segment

type insight

Electronic warfare (EW) is the fastest growing segment of the naval combat systems market as it plays a critical role in modern naval operations due to evolving threats and technological advancements. Increasingly sophisticated electronic threats such as radar, communications jamming, and cyberattacks are increasing the need for advanced email capabilities. Navies around the world prioritize electronic warfare systems that detect, destroy, and neutralize these threats to ensure mission success and survivability in conflict environments.

The rise of asymmetric warfare, in which non-state actors and small states employ unconventional tactics, further emphasizes the importance of electronic warfare. These attackers often rely on electronic means to level the playing field against technologically superior adversaries. As a result, navies are investing heavily in electronic warfare to counter these tactics, protect assets, and maintain strategic advantage.

Technological advances such as artificial intelligence (AI), machine learning (ML), and the integration of cyber capabilities are also driving the growth of electronic warfare in the naval sector. These innovations enable more sophisticated and adaptive electronic warfare systems that can respond to emerging threats in real time. Additionally, the shift to network-centric warfare, where information superiority is key, has increased the demand for electronic warfare systems that can protect communication networks and data links from electronic attacks.

The global geopolitical situation, characterized by heightened tensions and territorial disputes, especially in the maritime region, has led to increased naval spending on electronic warfare systems. Countries are upgrading their navies with cutting-edge electronic warfare technology to strengthen deterrence and ensure maritime security. This focus on modernizing naval combat systems, coupled with increasing reliance on electronic warfare and cyber warfare, is driving the rapid expansion of the electronic warfare segment in the naval combat systems market.

regional insights

Asia-Pacific region dominates the naval combat systems market due to its strategic importance, rising defense budgets, and ongoing territorial disputes. The region has vast oceans, including important sea lanes and disputed waters, making naval power a top priority for many Asia-Pacific countries. Countries such as China, India, Japan, and South Korea are investing heavily in modernizing their naval fleets to strengthen maritime security, assert territorial claims, and project power across the region.

China, as the region’s largest economy and military power, is a key driver of growth in the Asia-Pacific naval combat systems market. The country’s aggressive naval expansion, including the development of state-of-the-art destroyers, submarines, and aircraft carriers, is spurring other regional powers to expand their naval capabilities in response. This arms race has accelerated demand for cutting-edge naval warfare systems, including radar, sonar, missile defense, and electronic warfare systems, as countries seek to remain competitive.

The Asia-Pacific region is characterized by several ongoing territorial disputes, such as in the South China Sea and the East China Sea, further increasing the focus on naval power. These conflicts involve multiple states with overlapping claims, leading to increased naval deployments and the need for advanced combat systems to ensure maritime superiority and deter potential conflicts. is occurring.

The region’s economic growth has also played an important role in its dominance in the naval market. Rapid economic development has enabled Asia-Pacific countries to allocate significant resources to defense spending, allowing them to invest heavily in naval warfare systems. This economic strength, combined with the region’s geopolitical dynamics, has cemented Asia-Pacific’s position as a major market for the global naval combat systems industry.

Key attributes:

report attributes

detail

Number of pages

180

Forecast period

2023-2029

Estimated market value in 2023 (USD)

$36.77 billion

Projected market value to 2029 (USD)

$50.54 billion

compound annual growth rate

5.5%

Target area

global

Report scope:

major market players

BAE Systems PLC

lockheed martin company

RTX Co., Ltd.

Thales Group

General Dynamics Co., Ltd.

serve AB

L3 Harris Technologies Co., Ltd.

Northrop Grumman Corporation

Saffron SA

Elbit Systems Co., Ltd.

Naval Combat Systems Market, By Type:

weapon system

electronic warfare

C4ISR

Naval Combat Systems Market by Platform Type:

aircraft carrier

destroyer

frigate

corvette

submarine

Naval Combat Systems Market, By Region:

Asia Pacific

China

India

Japan

Indonesia

Thailand

South Korea

Australia

Europe and CIS countries

Germany

Spain

France

Russia

Italy

England

Belgium

North America

US

Canada

Mexico

south america

Brazil

Argentina

Columbia

middle east and africa

South Africa

turkey

Saudi Arabia

united arab emirates

For more information on this report, please visit https://www.researchandmarkets.com/r/ogu9px.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

Contact: Contact: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com EST Call 1-917-300-0470 for office hours. In the US/Canada, call toll-free 1-800-526-8630. GMT For office hours + call 353-1-416-8900

Source link